Low Income Taxpayer Clinic

The LITC grant program is a result of the IRS Restructuring and Reform of 199 8. Low Income Taxpayer Clinics (LITCs) represent low income taxpayers before the Internal Revenue Service (IRS) in audit, appeals, and collection issues, and federal tax litigation for free or for a nominal charge.

The clinics also provide educational workshops on tax issues to taxpayers for whom English is a second language.

The organizations that are generally funded are Non-Profit, Law Schools, Legal Aid Services, and Universities.

The clinics also provide educational workshops on tax issues to taxpayers for whom English is a second language.

The organizations that are generally funded are Non-Profit, Law Schools, Legal Aid Services, and Universities.

Obtain Full Opportunity Text:

Publication 3319

Additional Information of Eligibility:

The organizations generally funded are non-profit organizations, law schools or business schools.

Full Opportunity Web Address:

http://www.irs.gov/pub/irs-pdf/p3319.pdf

Contact:

William Beard Senior Program Analyst Phone 202-622-8972

Agency Email Description:

Work

Agency Email:

beard.william@irs.gov

Date Posted:

2009-05-21

Application Due Date:

2009-07-07

Archive Date:

2009-08-06

Social Entrepreneurship

Spotlight

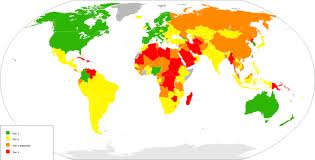

Rwanda as Social Entrepreneur Fund Beneficiary

The Republic of Rwanda has been picked as one of the six African countries as beneficiaries for a new fellowship fund program designed at supporting social entrepreneurs in tackling issues on food security.